Things you need to know about ethanol.

1. False report

The screenshot below of a brief newspaper report is being shared across various social media platforms. It claims that a company called Vivergo in Hull may close unless the government provides a rescue package. Vivergo argues that it requires assistance from the UK State because of the UK-US Economic Prosperity Deal (EPD), which will eliminate the UK’s tariffs on 1.4 billion litres of imported US ethanol. This is nonsense. Vivergo may be experiencing financial difficulties, but this is not attributable to US ethanol or the UK-US trade agreement.

2. The US is already the UK’s largest supplier

The US is already the UK’s largest supplier of ethanol, despite the UK imposing substantial Most Favoured Nation (MFN) tariffs of £16 per hectolitre for undenatured ethanol and £8.50 per hectolitre for denatured ethanol. The UK’s total ethanol imports have doubled in volume since making the addition of ethanol to petrol compulsory. Consequently, the UK’s largest suppliers have shifted from the Netherlands and France in 2020 to the US and Brazil in 2024, even with the tariffs applied to American and Brazilian ethanol. Last year, the tariffs averaged 24% of the import price; however, tariff-free ethanol from France and the Netherlands still could not compete with the two massive agricultural states, the US and Brazil.

The trade agreement with the US only removes tariffs on 1.4 billion litres of fuel, almost exactly the amount the UK imported last year. If more than this is imported, it will be subject to the UK’s MFN tariffs. As the UK imported 1.373 billion litres of ethanol last year, despite the significant tariffs, it is difficult to see how this is affecting Vivergo. The total volume of biofuels from UK-grown crops in 2023 produced only 153 million litres, which is just slightly more than the UK imported tariff-free from the EU. Is Vivergo complaining about tariff-free imports from the EU? Of course not! For some unfathomable reason, UK farmers are happy to be driven out of business by French farmers but not by American farmers. And no amount of ‘EU Resets’ will ever make paying 50% more for French (tariff-free) ethanol more sensible than imported US ethanol.

3. The real problem is not the tariffs, but rather the choice of crops and crop yields.

In the UK, ethanol is primarily produced from wheat. In 2023, 88% of UK ethanol was produced from wheat, while only 12% came from sugar beet. However, wheat has a low ethanol yield of just 277 gallons per acre. In contrast, corn, mainly used in the United States, yields 354 gallons per acre, whereas sugar cane, predominantly used in Brazil, yields 662 gallons per acre.

Viewed from another perspective, the UK is using more land to produce less ethanol than either the US or Brazil. Considering the differences in size and available farmland among the three countries, this is an inefficient use of valuable UK agricultural land.

There is also the issue of yields. The UK has experienced two poor years for wheat production. In 2023, production was only 13.9 million tonnes, down 11% from 2022 due to both a reduced area and lower yields. Unfortunately, 2024 was even worse. Wheat production fell to a mere 11.1 million tonnes, representing a further 20% drop from 2023. This was the smallest UK wheat harvest since 2020, caused by poor autumn planting conditions, resulting in an 11% reduction in planted area, and poor weather during the growing season led to a 10% decline in yields.

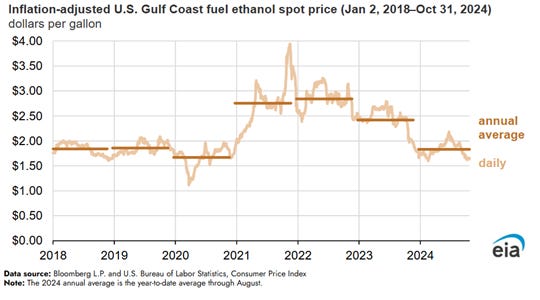

Meanwhile, the US has experienced two exceptional corn harvests, with record yields in 2024 reaching 183.1 bushels per acre, alongside a two billion bushel surplus carried over from 2023. This surplus equates to approximately 50 million tonnes. As a result, ethanol prices in the US were close to their 2020 lows.

Worse still for the UK, Brazil had ideal weather for sugarcane production. Brazil’s sugarcane harvest in 2023/24 was the highest ever recorded, producing 705 million tonnes. In the 2023/24 season, Brazil's ethanol production reached 35.3 billion litres, up from 34 million tonnes in 2022/23.

In addition to having more farmland, utilising higher ethanol-yielding crops, and experiencing two relatively better harvests, Brazil and the US also consume more ethanol in their petrol, which increases demand. Brazilian petrol must contain at least 25% ethanol, although some vehicles can run on 100% ethanol. While most petrol sold in the US contains 10% ethanol, they also sell variants with 15% and 85%. The UK has only recently made 5% and 10% compulsory in Great Britain and Northern Ireland as of November 2022. .

4. The UK population pay tariffs

Therefore, we should not impose a tariff on imported ethanol to protect a company from its own choices regarding crops and adverse weather conditions. Why should the UK Government be increasing the price of imported ethanol by 24% when it is now a compulsory additive in UK petrol? This raises transport costs for everyone and adds yet another burden to businesses. If a company, such as Vivergo, cannot compete unless its competitors have a 24% price increase, then perhaps Vivergo is in the wrong business.

5. Why is the UK subsidising ethanol in petrol when we have North Sea Oil?

But there is another, much more serious question we must ask: why is the UK using arable land to produce ethanol when it could be utilising North Sea oil? Petrol has a 50% higher energy density than ethanol. Petrol’s energy per litre is 32 MJ/litre, while ethanol’s is only 21 MJ/litre. This means that a car running on pure ethanol would require more fuel to travel the same distance.

The UK has only 16.8 million hectares of agricultural land, of which 6.2 million is cultivable, and only 4.1 million was used for arable crops in 2024, a drop of 5.4% from 2023. In 2023, 2.2% of the UK’s arable land was devoted to bioenergy crops: 47,600 hectares of wheat and sugar beet for bioethanol and 85,600 hectares of maize, miscanthus and short rotation coppice for biomass electricity generation. (A further 21,200 hectares were covered in ground-mounted solar panels as of September 2024, but that warrants another discussion.)

It is surely more sensible to import ethanol (tariff-free) from more efficient producers, such as the US or Brazil, rather than wasting UK arable land on bioenergy crops when we lack the climate to grow the most efficient crops and the weather to grow the less efficient ones consistently.